Give a new chance to your rejected clients

and go to waste

to apply for a loan again

to be issued

B2B platform to help banks and credit institutions reduce the wastage of loan applications

Revenue

Number of clients

-

Accelerate financial inclusionProvide an alternative offer for rejected borrowers if your risk model does not allow you to give them loans

-

Better customer experienceOffer an opportunity instead of a negative decision as added value for your clients

-

Increase customer loyaltyEnsure less negative experience with a personalized approach

-

Reduce acquisition costsBy selling your rejected applications to other credit providers

-

Get new clientsBy buying rejected applications from other financial institutions and pay for verified leads that match all your parameters

-

Free of chargeThere is no hidden fees or payments for using our platform as we take brokerage from credit institutions

-

SecureWe care about personal data protection, and data is used only for the matchmaking process to find another credit provider

-

FastThe opportunity to get an alternative credit offer in minutes after submitting an application

-

Time-savingNo need to search for a loan again and constantly fill out new application forms

-

Transparent and reliableWe cooperate only with trusted partners that care about their reputation

The scope of use

- Payday loans

- Consumer loans

- Auto loans

- Mortgages

- Loans for SMEs

- + 20 more

- Lending

- Leasing

- Factoring

-

Trusted credit institutionsWe cooperate only with trusted credit institutions which put the customer first

-

International standardsWe deploy international standards focused on information security ISO 27000

-

GDPR complianceWe are committed to keep customers' data protected and safeguard their rights by GDPR compliance

-

Security trainingWe provide security training for all staff and regularly check our system

credit offer after a negative decision

- Meeting

- Integration

- Free trial

- Get benefits

We discuss your borrowers’ rejection process and what kind of problems do you face on a daily basis. How you reject your customers and what alternatives you provide to your rejected borrowers.

Demo of the Ninja lender platform. We introduce you to our system and discuss how we can help to solve your existing problems.

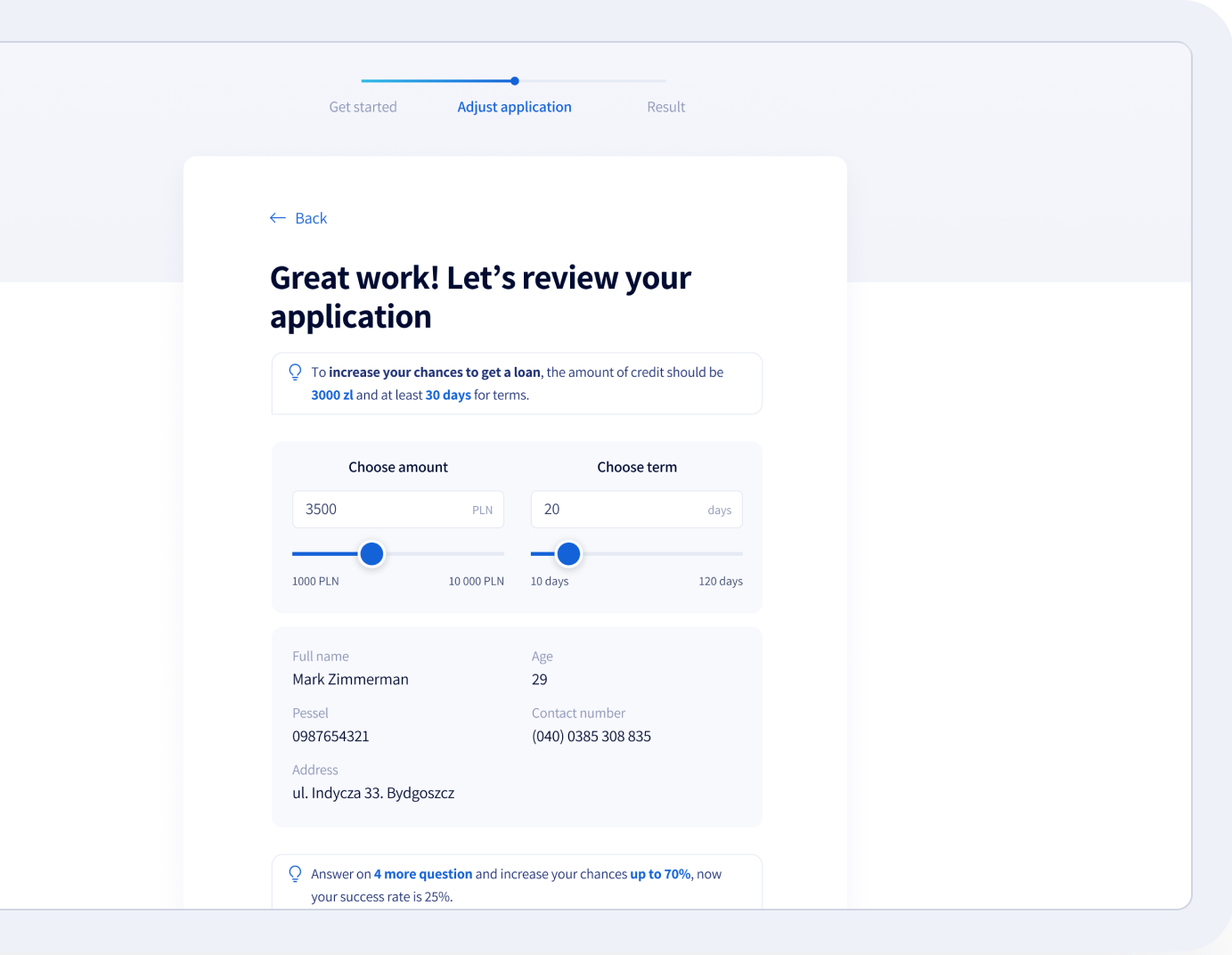

Sign an NDA to protect your confidential information and give access to Ninja Lender’s demo environment. You will be able to test the platform, check features, and give us your feedback.

Our IT professional will work together with your team to understand the business flow and write the integration scripts with your data sources. We will test the modules/components when integrated to verify that the system works as expected.

After integration, you will have full access to our platform and its features. You will be able to sell or buy rejected loan applications without our commission to understand how it fits your business model.

Start using Ninja Lender to help your rejected borrowers with securing their needs and increase your business efficiency

– get verified leads

– reduce acquisition costs

– increase customer loyalty

-

Support of any loan typeOur platform is created to support a variety of loan types, including personal and SME loans

-

Get extra from cooperationYou will know if your rejected client got a loan from another credit provider

-

Automation via APIFast-to-integrate and easy-to-use technology for exchanging any data between our systems